Holistic Approach Towards M&A Target Screening

The widespread use of mergers and acquisitions by corporates to achieve growth and other strategic goals can be traced back to the late 19th century. While we commonly observe CEOs touting certain deals as “rare, once-in-a-lifetime, value creating” opportunities, the outcome of a M&A transaction is often uncertain at announcement and subject to a myriad of factors such as integration of business operations, realization of costs synergies, retention of talented individuals etc.

The AOL – Time Warner transaction is merely one of numerous high profile examples (see appendix) where shareholders ended up paying the price when corporate executives are caught up in the hubris, overpay and fail to exercise sufficient discipline during the evaluation / due diligence process. As noted in a Harvard Business Review article, “typically 70% – 90% of acquisitions are abysmal failures.”

In my experience, companies with a good, long term track record in corporate M&A tend to implement a strategic framework to screen and prioritize targets that are aligned with overall firm strategy, rather than relying on the deal making prowess of a few executives.

Systematic target screening

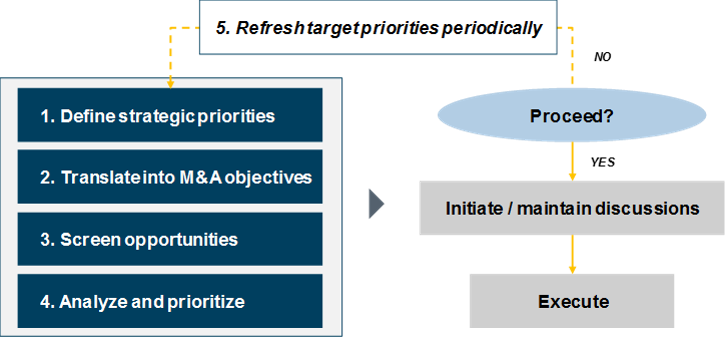

A formal screening process will help to ensure M&A activities remain closely linked to overall strategic priorities and provide for flexibility to exploit unplanned opportunities as well as avoid “knee-jerk” reactions to inbound ideas.

The key stages of a structured target screening process will generally comprise of the following:

1. Define strategic priorities

Group level strategy are often articulated to manage shareholders’ expectations (e.g. focus on North Asia as key profit driver or increase profitability with renewed risk discipline) and lack sufficient operational details. As such, dialogues with C-suit executives and business divisional leaders (e.g. facilitated by the CFO office or Strategy team) are necessary to derive a bottom-up alignment of business level strategy with companywide priorities. This will in turn help to ensure that that capital, management bandwidth and other resources are allocated to key focus areas in a transparent fashion.

2. Translate into M&A objectives

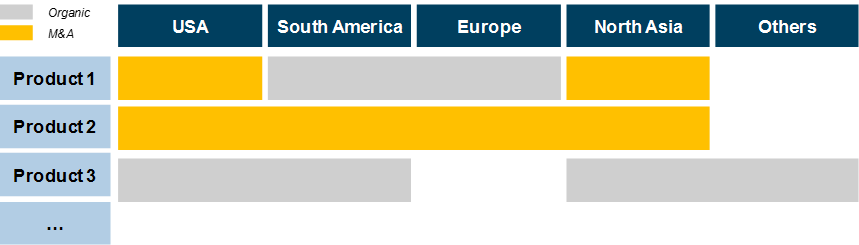

Business level strategic intent drives product and market priorities i.e. what product to invest for short term profitability, which country to manage for stable growth. These priorities can then be mapped (as illustrated below) to identify areas where organic growth makes sense and determine situations where M&A may be necessary to realize business targets.

3. Screen opportunities

It may be advisable to first develop “long list” of potential targets based on board market screening before filtering using criteria agreed with the business leaders (e.g. financial impact, integration complexity). This will help to ensure a methodical and comprehensive coverage of the entire target universe (i.e. reduce missed opportunities) while generating a manageable list of targets to monitor for different business divisions. Amalgamating strategic priorities maps and target lists across different business divisions into a Group level target list can also help to generate “transformational” ideas (i.e. large deals which impact multiple business units and require coordination at the HQ level) or potential for transaction synergies.

4. Analyze and prioritize

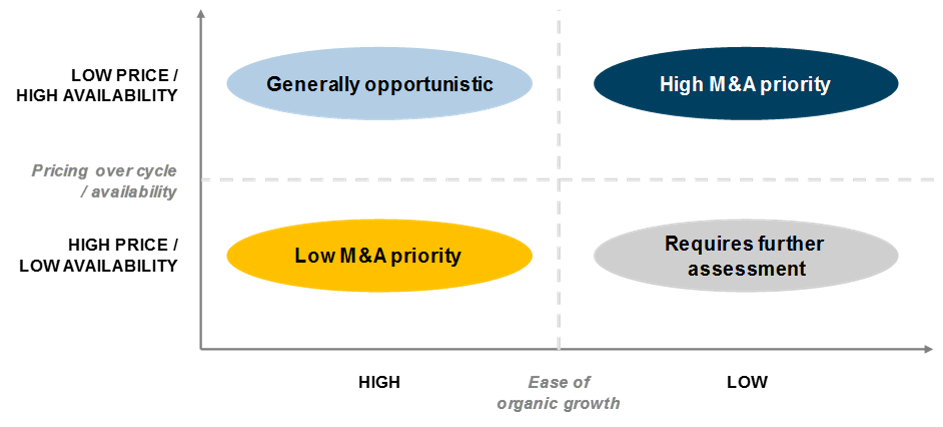

Perhaps the trickiest aspect of the screening process is to develop an intuitive prioritization methodology to “order and rank” targets with different characteristics. As illustrated in the example below, a simple 2 x 2 matrix may be sufficient in yielding practical insights and identifying the primary targets without being overly complex.

While there are no hard and fast rules, the use of objective externally determined parameters such as the following are highly recommended:

- Pricing over cycle/ availability describes the relative valuation of a target compared to historical valuations over its business cycle and takes scarcity of the asset into consideration

- Ease of organic growth on the other hand depicts the acquirer’s ability to substitute the proposed M&A initiative by developing capabilities organically.

Senior executives can then proceed to initiate and maintain informal dialogues with “High M&A priority” targets or react quickly to market developments pertaining to such targets. Similarly, “opportunistic” targets should only be pursued if the potential acquisition price is at a significant discount to the intrinsic value. Management should exercise discipline in rejecting inbound opportunities if neither strategic nor financial criteria are satisfied to avoid wasting time and resources.

5. Refresh target priorities periodically

To ensure that the business division and company-level target lists remain relevant, it is important to revisit and refresh the target priorities on a periodic basis (e.g. annually or semi-annually).

Conclusion

Similar to the use of financial leverage, corporate M&A is simply a tool that can create or destroy value. It is particularly critical in an environment of capital constraints to identify the most suitable M&A opportunities and to prioritize investments. Large corporates with different business interests may also benefit from having a structured M&A approach which minimizes the risk of missing out on ad hoc “good deals” or pursuing less than ideal targets. A systematic approach towards M&A target screening may not be a panacea for “buyer’s remorse” but it may prove helpful to lower risks and beat the odds.

Appendix – examples of value destroying M&A transactions